“A specialized consulting firm with an unexpected spike in demand might take many months to hire new staff and ramp them, and so faces the unenviable decision of either turning down work, making customers wait, or over-working staff.”

An Emphasis on Human Ingenuity

A good Professional Services firm will store value in knowledge assets, procedures, and management systems, and will seek to make their offering as repeatable as possible. While these are helpful and necessary tools, it is the people who ultimately deliver value to the customer. When you hire McKinsey, you aren’t asking them to ship you an expensive playbook so that you can roll up your sleeves and figure it out on your own; you expect talented individuals who can help you solve problems. People are the liaison between the customer and the professional service firm’s collective body of knowledge and expertise.

Download our white paper on this topic

FP&A Challenges

There are over two million Professional, Scientific, and Technical services firms in North America. These firms drive value through their human capital and include segments such as management consulting, legal, accounting, engineering and architecture, technology services, and marketing agencies. It’s a segment whose share of the US economy has grown consistently since 2008 and is unlikely to start shrinking any time soon. While some industries can be easily off-shored, automated, or simplified through technology, the increasing complexity of our world means we need experts, advisors, and specialists more than ever.

These firms have many challenges in common when if comes to financial and operational planning:

- Providing accurate revenue and margin guidance for the month, quarter, or year.

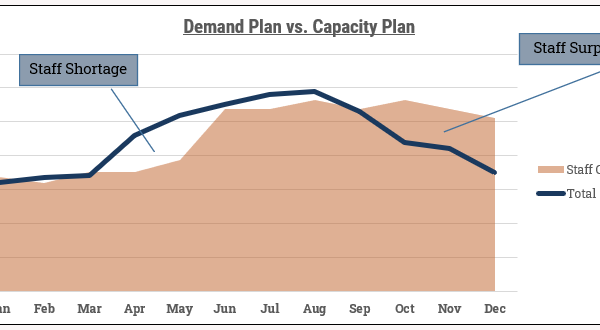

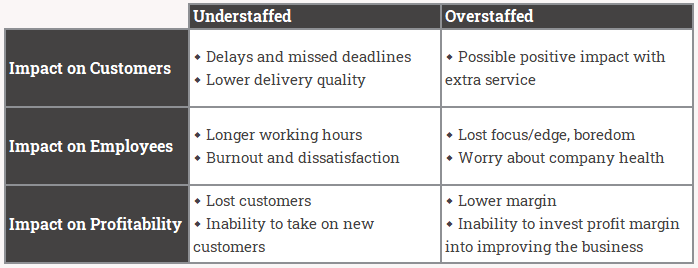

- Setting the right staffing levels to avoid being overstaffed or understaffed, to handle seasonality, and to understand when 3rd party or external staffing options are required.

- Understanding the impact of the current financial plan on cash collection and the balance sheet.

- Understanding and quickly turning around new iterations and scenarios of the plan based on changing market conditions or revised sales plans.

- Tracking key performance indicators at both aggregate staff and individual employee levels.

Staffing levels in particular have a huge impact on a Professional Services firm and is the linchpin of the whole plan. Consider the impacts of over-staffing or under-staffing.

A services firm doesn’t get to enjoy many of the benefits that other business models have. To account for seasonal demand, a retailer can use a warehouse to store products in advance and maintain the value for future use. A public accounting firm, on the other hand, deals with seasonality by increasing work hours during peak times and then dropping prices considerably during the off-season to keep people productive.

A manufacturer with an unexpected spike in product demand may have the ability to add another production shift and quickly hire temp staff to meet the need. A specialized consulting firm with an unexpected spike in demand might take many months to hire new staff and ramp them, and so faces the unenviable decision of either turning down work, making customers wait, or over-working staff.

A great FP&A methodology is important to be able to get out in front of these challenges.

FP&A for Professional Services

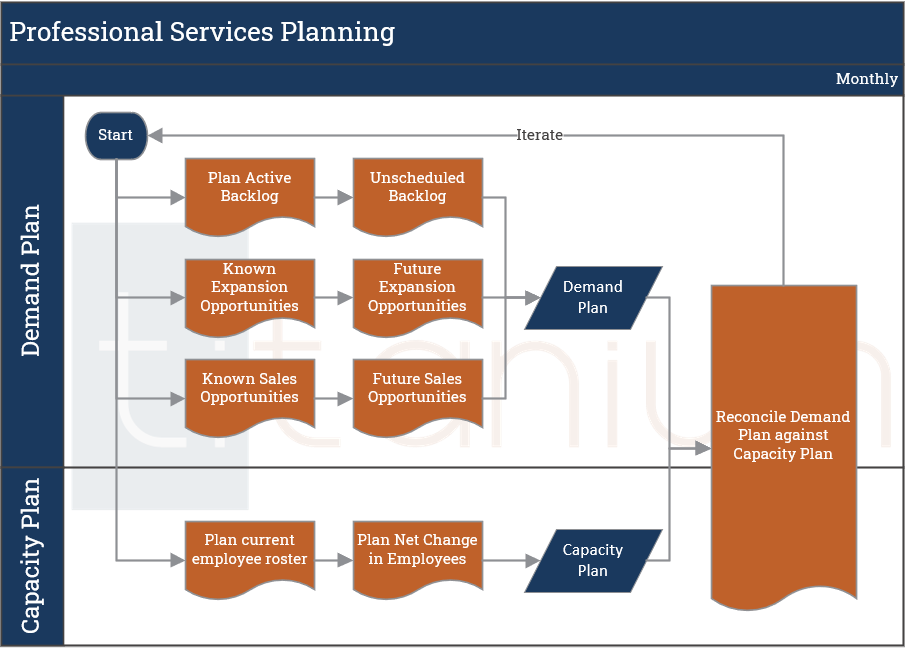

Finance and Professional services leaders need three ingredients to overcome these challenges. The first is a robust FP&A Professional Services methodology. The major elements of an FP&A methodology for Professional Services:

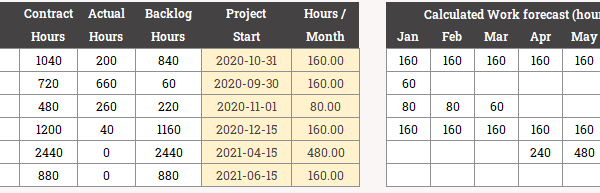

- Forecast your expected demand coming from your backlog. This is the project work coming from all your active projects.

- Forecast your expected demand coming from expansion and sales efforts. This is the expected future work coming from your sales pipeline and other sources.

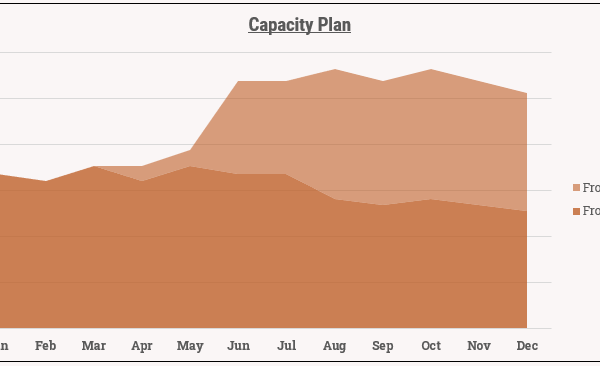

- Forecast your available capacity, by looking at changes in your existing employee roster and forecasting the new staff required.

- Reconcile the demand against capacity. Iterate and revise your forecast until you’re satisfied customers will have full coverage, while still meeting your revenue, margin, and cash goals.

We encourage you to read our whitepaper linked below to see further detail. We’ll also cover these in future posts.

Make the easy stuff easy

The second ingredient is technology. An effective planning methodology needs to be complemented by an FP&A / CPM / EPM system. Well-configured FP&A software provides numerous benefits for a Professional Services firm:

- Load data automatically from your ERP, PSA, HRIS, CRM, or time tracking systems and feed these directly into reports and input templates.

- Build driver-based planning models that calculate revenue and staffing demand automatically based on expected bookings. Create and compare different what-if scenarios side-by-side.

- Capture end-user discretionary inputs like sales or backlog adjustments and inject more realism into the plan.

- Foster collaboration across the team with structured workflow on a weekly or monthly basis and enforce a regular variance analysis process to track performance closely.

The adoption of technology makes the easy stuff easy. It lets you forecast quickly and often. When you have an accurate and current picture of your services business, better decision making follows. We run a vendor selection process where we match up the best FP&A / CPM product with your business needs.

End-to-End teamwork

The third is buy-in from your staff. To understand your backlog, you need your project teams to follow the process and use the technology, otherwise the output will be unrealistic. To predict likely employee attrition, your management team needs a good handle on staff morale and potential future moves. To forecast your new sales demand, those responsible for sales and marketing need to use the CRM tools and keep opportunities up-to-date. Regardless of the final process and technology applications you use, getting everyone on the same page and cooperating will maximize the effectiveness of your FP&A process.